CHARLOTTE, N.C., June 29, 2016 /PRNewswire/ -- A new report by LendingTree®, the nation's leading online loan marketplace, finds that mortgage rates offered by lenders on LendingTree's network have fallen 14 basis points since the United Kingdom voted to leave the European Union.

In response, LendingTree has seen a substantial increase in refinance requests as the dramatic market reaction to Britain's exit from the EU continues to drive down mortgage rates. Requests for purchase mortgage loans have also increased since the Brexit news.

"This historic event has created an opportunity for US borrowers to lock in some of the lowest interest rates we've seen since December 2012," said Doug Lebda, founder and CEO of LendingTree. "We're seeing 30-year fixed-rates as low as 3.21% APR, which means there is a massive window of opportunity for borrowers to save."

Prime and mid-prime borrowers are taking notice of the falling interest rates. The number of total refinance requests from prime borrowers, those with credit scores over 680, have increased more than 100 percent week-over-week. Mid-prime borrowers, those with credit scores between 620 and 680, have also shown interest in capitalizing on lower rates, with requests from these borrowers increasing well over 50 percent week-over-week.

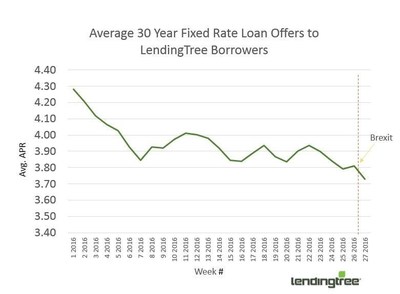

Since January of this year, average offered interest rates have fallen from 4.28 percent to an average of 3.73 percent following the Brexit news. Last Thursday, June 23, 2016, average offered interest rates for a 30 year fixed-rate mortgage were 3.84 percent. "On a $275,000 loan, a 55 basis point decline in interest rate translates to roughly $31,500 in potential savings on payments toward interest," said Lebda.

The chart below shows the rate movement for rates (APRs) offered to borrowers from lenders on LendingTree's network along with the Brexit inflection point:

Lebda continued, "For people who have been hesitant to purchase a home or to even refinance an existing mortgage with an interest rate in the mid to high four percent range, the opportunity to save is there, although no one can say how long the opportunity will last."

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 55 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 350 lenders offering home loans, personal loans, credit cards,

student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

704-943-8208

Megan.Greuling@lendingtree.com

Photo - http://photos.prnewswire.com/prnh/20160629/384853

Logo - http://photos.prnewswire.com/prnh/20110518/MM04455LOGO

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/lendingtree-report-brexit-sends-mortgage-rates-into-freefall-300292123.html

SOURCE LendingTree