CompareCards Survey Reveals Widespread Misconceptions About Debit Cards

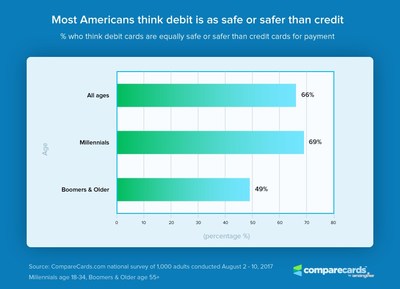

Millennials are more likely to buy into this misconception than older generations. The survey found that 69% of millennials believe that debit cards are as safe or safer than credit cards, while 49% of baby boomers and older Americans believe this. More than half of people (56%) who use debit cards most often for everyday purchases believe debit cards offer the same protection as credit cards.

The youngest millennials are the most unaware of the differences between credit and debit card protections. Only 27% of the youngest millennials (18-24) said credit cards were the safest way to pay. The oldest baby boomers (65+) were most aware that credit cards are a safer way to pay at 56%.

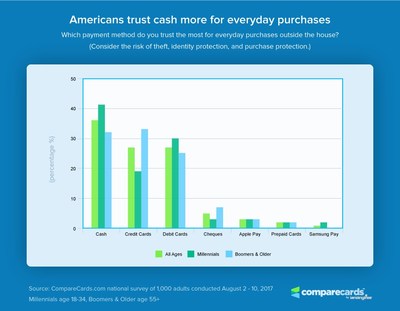

Americans trust cash the most (36%) for everyday purchases outside the house, yet 38% of people carry less than

Most credit card issuers now offer

On the other hand, if a debit card is lost or stolen, the maximum liability on fraudulent charges depends on how long until it's reported to the bank. Individuals can be liable from

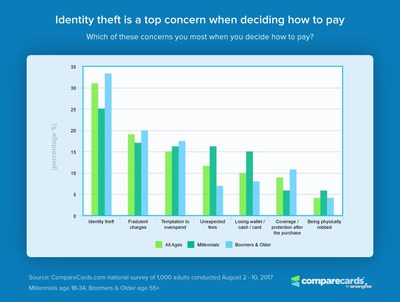

"Boomers have more fears about identity theft, our survey found. But, if hackers got hold of your credit card number, this is one of the easier issues to resolve as most credit card issuers now offer

Some other insights revealed from the survey data include:

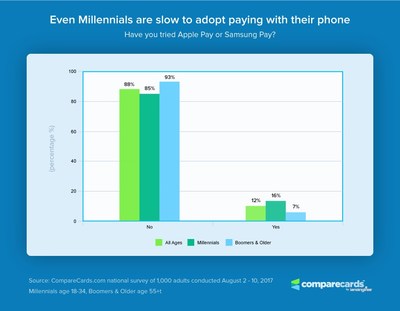

There is a low adoption of pay with phone technology, and even millennials are slow to adopt paying with their phone.

Americans trust cash more for everyday purchases.

Identity theft is of concern when determining payment methods.

Click here for complete survey findings.

METHODOLOGY

CompareCards commissioned Google Surveys to obtain online survey data with 1,000 adults living in

*Actual response rate per question varied from 799 to 1159 respondents.

About CompareCards

CompareCards' mission is to help people make smarter, more informed, healthier financial decisions based on deeper knowledge of financial offers. Each month, over 2.7 million visitors come to CompareCards' website to independently compare credit cards side-by-side and choose a credit card based on interest rate, reward benefit, cost savings, and other factors that are important to each person. CompareCards provides easy-to-use, objective tools and educational resources that help people do everything from making credit card comparisons to managing their credit health. For more information, please visit www.comparecards.com.

The CompareCards division of

About

MEDIA CONTACT:

704-943-8208

Megan.Greuling@LendingTree.com

View original content with multimedia:http://www.prnewswire.com/news-releases/comparecards-survey-reveals-widespread-misconceptions-about-debit-cards-300515649.html

SOURCE

News Provided by Acquire Media